DIEM, an ERC-20 token issued on the Base blockchain, has risen nearly 120% over the past month, outpacing much of the broader cryptocurrency market amid growing interest in tokenized AI computing.

Tokenized AI Computing Spotted as DIEM Rise Nearly 120% in 30 Days

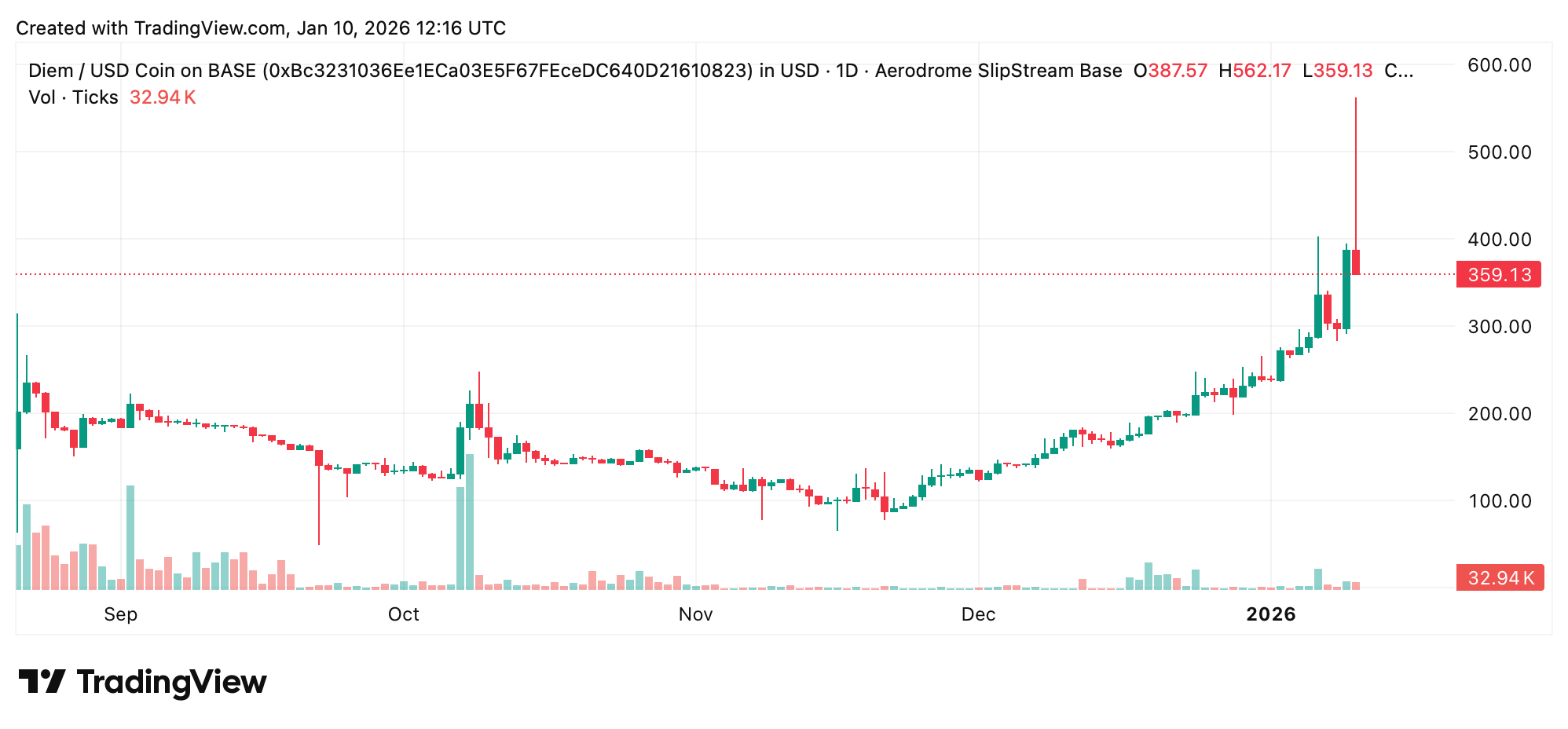

Last week, DIEM traded in a wide range between $263 and $426, with the period beginning around $263 and ending well above that level by the end of the week. DIEM is trading at $360 per coin as of 7:45 AM ET on Saturday, January 10, 2026. According to market data, the weekly increase has reached approximately 34%, and the token’s market capitalization now stands at more than $13 million.

This price movement comes at a time when many digital assets are moving sideways, placing DIEM among a small group of tokens with strong relative performance. With a circulating supply of just over 36,000 tokens, even modest changes in demand result in noticeable price fluctuations.

DIEM was launched in August 2025 by Venice AI as a tradable form of tokenized AI computing. The token is designed to provide holders with continuous access to AI inference, rather than a fixed-term subscription, and is distinct from typical software licensing models. The launch was initially controversial, but Venice’s user growth (more than 400,000 registered users) and integration with top AI models have helped counter this controversy.

Essentially, each DIEM staked unlocks $1 worth of AI credits per day on the Venice platform, which resets every day at midnight UTC. These credits can be used for text, images, and other AI tasks through the Venice web application or API without accumulating if unused. Holders can stake, unstake, trade, or burn DIEM at any time, but there is a one-day delay in unstaking.

Venice aggregates access to multiple AI models into a single interface, positioning DIEM as a utility token tied directly to compute usage rather than governance or speculative incentives. Tokens are not inflationary. Its supply is managed by a capped mint curve that approaches a long-term goal of approximately 38,000 tokens.

The project was founded by Erik Voorhees, known for creating Satoshi Dice and Shapeshift. Voorhees publicly framed DIEM as a way to simplify access to major AI systems without recurring payments. These days, Voorhees has frequently mentioned DIEM regarding X, highlighting key milestones while explaining why the token has resonated with users.

“People are starting to realize that with DIEM, they can access all their AI models for free, both in the Venice.ai app or API,” Voorhees wrote this week. “Claude Opus 4.5, GPT 5.1, Gemini 3, Nano Banana Pro, GLM 4.7 and many more.”

Also read: UK creates regulatory framework for crypto companies

DIEM is minted by Venice’s native rock Tourist information center The token creates a closed-loop mechanism where computing demand locks capital elsewhere in the ecosystem. Writing DIEM returns the original Tourist information center It was used to mint and strengthened the relationship between supply and demand in public works.

Recent gains appear to reflect growing awareness of this structure, as traders and users appreciate DIEM’s role as a perpetual access token rather than a traditional AI subscription or governance asset.

How long that demand lasts will ultimately be determined over time. Venice also faces significant competition from established decentralized AI protocols, including Hugging Face and other services in the computing market, which could constrain widespread adoption. Still, some observers argue that Venice’s privacy-preserving design could differentiate it from competing platforms.

Frequently asked questions 🤖

- What is DIEM used for?DIEM provides daily updated AI computing credits when you bet on the Venice platform.

- Why has the price of DIEM increased recently?Market participants are increasingly interested in tokenized AI computing and utility-based designs for DIEM.

- How does DIEM generate AI access?Each staked token unlocks $1 in AI credits per day that can be used via Venice’s app or API.

- Is DIEM inflationary?No, DIEM supply is limited by a controlled casting curve associated with the lock. Tourist information center token.