Vitalik Buterin, co-founder of Ethereum, recently highlighted both potential benefits and risks, and shared his views on the Treasury’s role in ecosystems.

In an interview with the Bankles Podcast, Butalin jokingly called the US government his favorite “finance company,” noting his appreciation for the era when authorities confiscated stolen Ethereum.

Pros and Cons of the Ministry of Finance

Ethereum’s Treasury Department includes companies that allocate a portion of their corporate reserves to ether (ETH), giving investors an indirect exposure to cryptocurrency.

Buterin acknowledged the benefits of this practice and said it offers an alternative for finance companies to access ETH. “It’s also good to have different vehicles to make people have access to ETH,” he explained, adding that the Ethereum ecosystem will ultimately be strengthened.

At the same time, butarine warned against the risk of over-leverage. “If I wake up three years from now and say that the Treasury has led to the downfall of ETH, then… basically, my guess as to whether they’ll somehow turn into a game of over-leverage,” he warned.

Despite concerns, he expressed confidence in Ethereum community and institution participants, describing them as “responsible people” who are unlikely to allow the Treasury to destabilise the network.

Ethereum ETF hits records

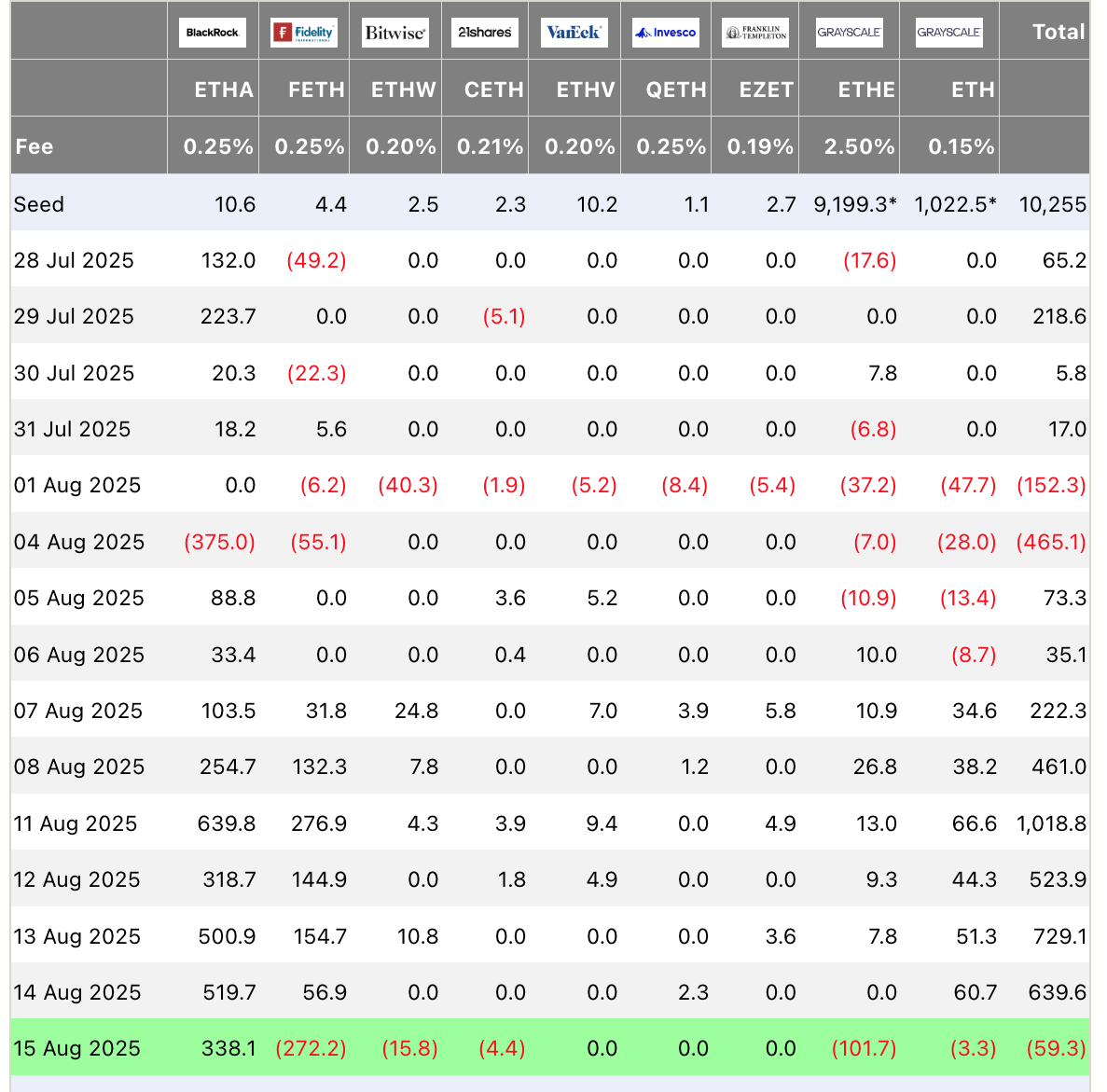

Meanwhile, Ethereum ETFs are seeing unprecedented demand. This week alone, net inflows reached a record $2.85 billion, with trading volumes rising sharply above $17 billion.

Spot Bitcoin + Ether Etfs won a volume of about $400 billion this week. It corresponds to a huge number, top 5 ETFs or top 10 stock volumes. pic.twitter.com/z89uv63a3w

– Eric Balchunas (@ericbalchunas) August 15, 2025

On Monday, Spot Ethereum ETFS recorded its largest daily net inflow to date, totaling $1.01 billion. Over the first two weeks of August, they have seen an influx of over $3 billion.

BlackRock’s Ishares Ethereum ETF led the fees with an inflow of $519 million on August 14th. Meanwhile, all funds ended with a small net flow of $59 million.

At the end of July, asset managers had already collected $11.4 billion worth of Ethereum within weeks, showing strong belief in ETH despite market volatility.