Crypto.com’s Cronos, Bitget Token, Circle’s USDC Whale activity has increased sharply over the past seven days, even though the prices of both exchange tokens have fallen by more than 7% during this period.

Santiment Feed’s on-chain analysis shows that among tokens with a market capitalization above $500 million, Kronos and Viget tokens recorded the steepest week-over-week increases in whale activity. Whale trading on Cronos increased by more than 1,100% compared to the previous week, and Bitget token activity increased by 800%.

USDC The value of Optimism also rose more than five times over the same period, making the stablecoin one of the most transferred assets despite its price being pegged at $1.

Due to whale activity, imminent increase in currency trading volumes is being considered

According to Santiment’s research, upward trends in whale crypto exchange-related token transfers are typically preceded by periods of spikes in volatility and changes in liquidity. In the early market cycle, the surge in whale transfers on Cronos coincided with an increase in on-chain trading and centralized trading volume on Crypto.com.

Kronos, Biget, USDC Whale trading chart. Source: Santiment.

CRO Whale trading has surged 1,111% in the past seven days, Santiment said. This spike occurred despite a 75% decline in whale activity over a 30-day period. CROThe price fell by 0.5% and the daily trading volume decreased by more than 25%.

whale trading BGB 800% increase compared to the previous week. Unlike Kronos, the BitGet token saw modest price increases in the short term, gaining about 0.25% on the day and trading volume increasing by 75%.

However, over a 30-day period, whale activity BGB This is probably due to a sudden but localized resurgence of large-scale transfers, but it still fell by about 16%. At the time of this report, BGB was trading at $3.65, with a 24-hour trading volume of $110 million.

“This is a strong sign that whales are relocating within their ecosystems. Both CRO and BGB “Whale spikes are often preceded by spikes in trading volumes, which means usage on both platforms is very likely to be much higher than normal,” Santiment wrote in a post on X.

Meanwhile, trading of the stablecoin USD coin on Optimism increased by about 528% from the previous week and 94% on a 30-day basis, but the daily trading volume decreased by nearly 22%. On the same blockchain network, wrapped ether activity increased 710% week over week on the back of a strong rebound in 30-day whale activity, which increased by more than 132%.

Rapid increase in Bitcoin whale accumulation, is a bull market coming?

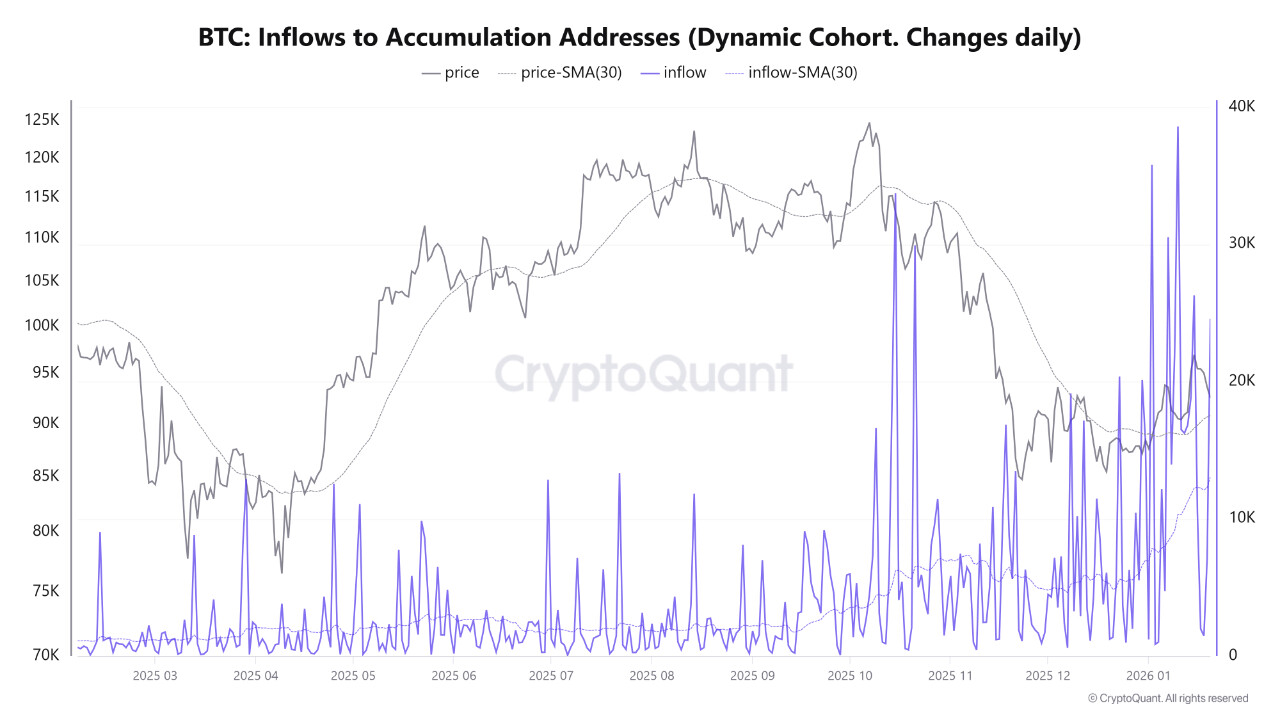

The surge in altcoin and stablecoin whale activity comes on the heels of a sustained phase of accumulation by Bitcoin whales since the beginning of the year. A chart from CryptoQuant, which tracks inflows to Bitcoin storage addresses, shows that large holders have continued to add the coin to their portfolios, even as the coin has fallen from a yearly high of $97,000 to below $90,000.

BTC Foreign exchange inflow. Source: CryptoQuant.

From early January to late 2025, Bitcoin inflows to storage addresses were mostly at high levels. Towards the middle of the year, the market saw a notable surge in July and August, with inflows exceeding 10,000 people. BTC For a few days.

In October and November, inflows into accumulation addresses accelerated, with several sessions recording inflows of 20,000. BTC Or more. Data shows that by early in the new year, daily inflows briefly reached nearly 40,000 people, the upper limit of the observation range. BTC last week.

A wallet held by short-term holders. Defined as >1,000 carriers under 5 months of age. BTCalso increased steadily throughout the second half of 2025. The number of these wallets was on the rise heading into January, even after the October 10 liquidation event that took about $20 billion from the market.