The performance of the DOP token market raises questions

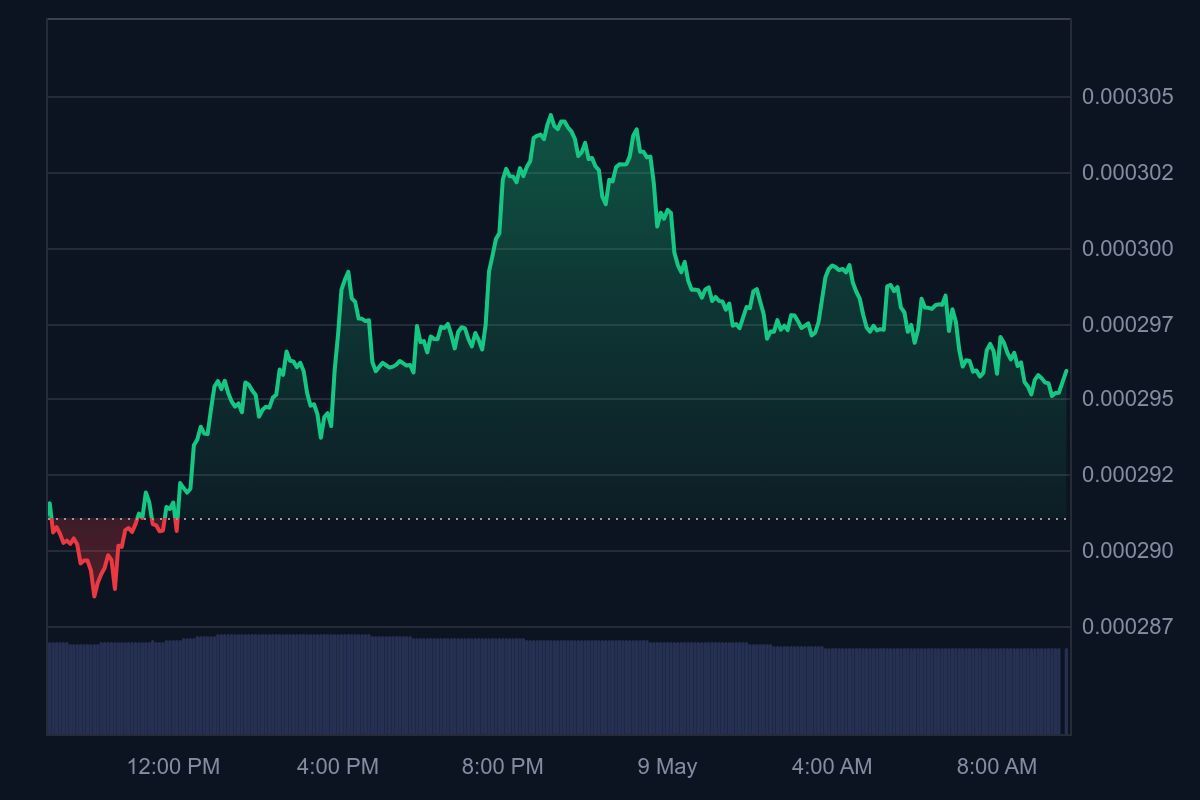

The Data Ownership Protocol (DOP) is currently trading at around $0.0002,951, showing a modest 1.70% increase over the last 24 hours. With its market capitalization of $2.57 million and daily trading volume of $1.53 million, the token maintains an astonishingly large amount of market cap ratios nearly 60%. This extraordinarily high trading activity against market size often triggers scrutiny among experienced cryptocurrency analysts, as it may indicate potential market manipulation tactics.

DOP/USD price for past days – CoinMarketCap

The project reports a circular supply of 8.73 billion DOPs from a total supply of 23.34 billion tokens. The fully diluted rating is $6.92 million. These numbers look transparent, but when viewed alongside others regarding aspects of the project, they guarantee a thorough investigation.

Red flag: Examining DOP claims and manipulation

Data Ownership Protocol is sold as an innovative solution for data sovereignty in the blockchain space. However, an investigation into the technical documents revealed a significant contradiction between promises and implementation. The white paper contains ambiguous descriptions of technical frameworks with limited technical specifications or peer reviews.

Additionally, the whitepaper for the project added to the website header is not open, and you will see an error. This lack of technological advancement contradicts the ambitious roadmap presented in official channels. Industry experts point out that the basic technology needed to realize the promise of DOP requires significantly more robust development efforts than is currently proven.

Also, since their last apology, they have not done anything important to address community concerns.

Abnormal holder distribution patterns

One particularly noteworthy metric is the 111,340 holders reported by the DOP. For projects with relatively low market capitalization, this number appears questionably high. This typical project of market capitalization ($2-3 million) generally maintains thousands of ownership. Analysis of on-chain data suggests potential wallet fragmentation. This is a technique that is sometimes employed to create a wide range of adoption fantasies.

Blockchain analysis revealed that a significant proportion of these wallets hold minimal tokens and that their holdings are concentrated among a small number of addresses. This distribution pattern deviates from the healthy adoption curve seen in legitimate cryptocurrency projects.

Investor Advisory: Essential for Due Diligence

Cryptocurrency investors should take caution and approach the DOP and carry out thorough due diligence. Before considering investing in a data ownership protocol or similar projects, experts recommend:

- Verifying team credentials and background

- Examine the code repository for active development

- Analysis of token distribution and early investor allocation

- Reading independent security audits from reputable companies

- Examining the technical feasibility of project claims

- Investigating community engagement beyond marketing efforts

The cryptocurrency space continues to attract both innovative projects and questionable schemes. Distinguishing between legitimate innovation and potential fraud remains important for investor protection in this rapidly evolving market.

Regulatory perspectives and industry standards

Regulators around the world are increasing scrutiny of cryptocurrency projects that make ambitious claims without a substantial technical foundation. Although the DOP is not formally classified as a fraud by major regulators, it exhibits several characteristics that often spark research interest.

Industry self-regulatory groups such as the Blockchain Transparent Institute and the Encrypted Alliance have developed frameworks to assess the legitimacy of the project. When measured against these criteria, the data ownership protocol provides multiple warning signs to alert investors.