As the wider markets see potential rebounds as macroeconomic volatility ease, crypto whales have begun to spin capital into selected assets.

On-chain data shows a significant accumulation in Ethereum (ETH), ONDO, and ChainLink (Link), with large holders positioning themselves for profit this month.

Ethereum (eth)

Ethereum is the top target for crypto whales this month. Despite Altcoin’s inactive performance over the past week, large holders seized the opportunity to accumulate. They increased their net inflow as they are located for potential benefits over the coming weeks.

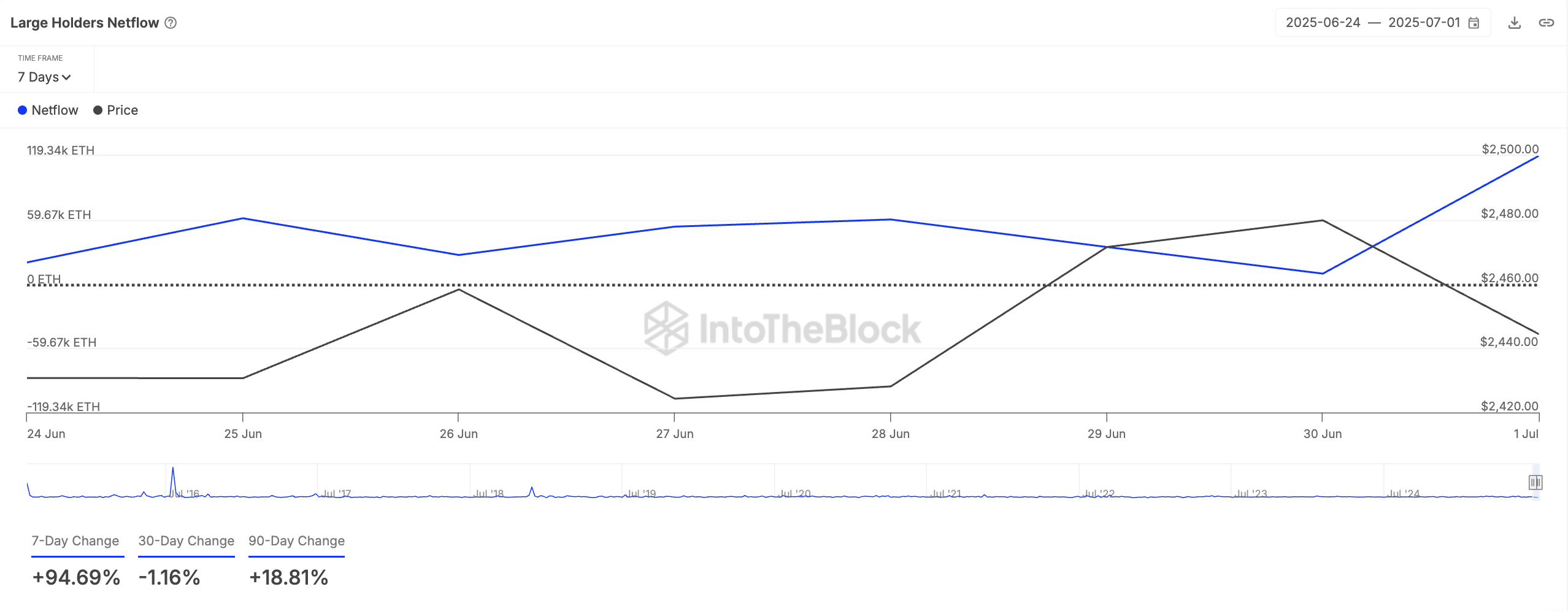

With each data from IntotheBlock, Netflow, a large holder of ETH, has skyrocketed 95% over the past week, reflecting an increase in demand from this group of investors.

Ethereum Large Holders Netflow. Source: IntotheBlock

Larger holders are investors who hold more than 0.1% of the distribution supply of assets. Their Netflow measures the difference in the amount of tokens a whale buys and sells over a specified period.

Upon climbing, it shows a strong accumulation by whales. This trend could encourage retailers to strengthen their ETH accumulation and increase their value in the short term.

ondo

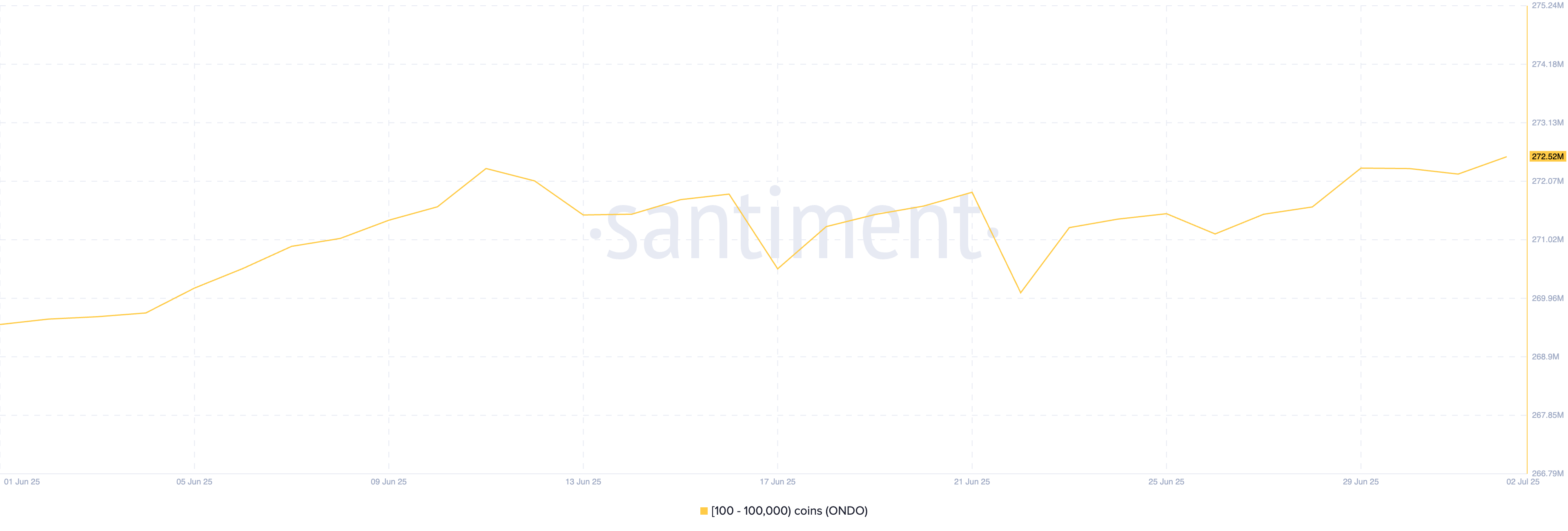

The RWA-based Token Ondo is another asset that Crypto whales are paying attention this month. Data from Santiment shows a noticeable rise in coin holdings for whale wallet addresses that hold 100-100,000 Ondo tokens.

Over the past week, the group has collectively accumulated 3 million tokens, indicating a growing confidence in Ondo’s short-term performance.

ONDO supply distribution. Source: Santiment

If demand for this whale continues to grow, it could provide the momentum needed to exceed Ondo’s price by $0.92 above key resistance level.

Conversely, if market sentiment changes and whales move to secure profits, the token will be raised to $0.66.

ChainLink

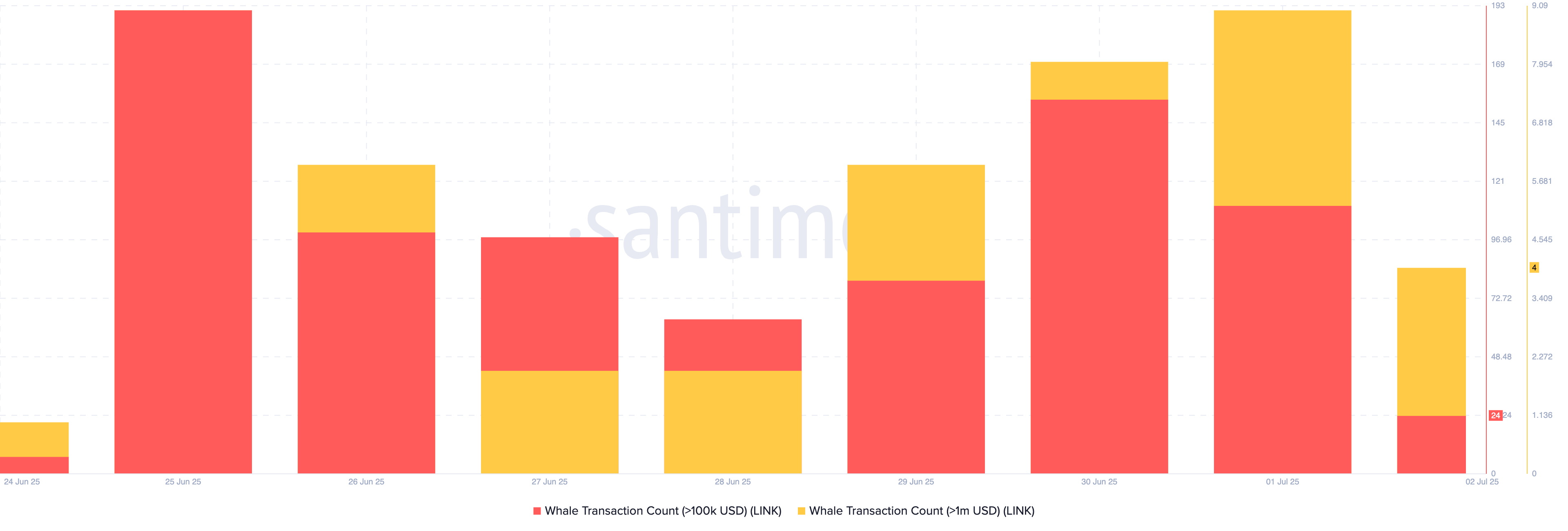

The link shows a surge in whale trading activity over the past few days, showing increased confidence in the short-term performance of tokens.

Data from Santiment shows that the number of linked transactions, which exceed $100,000 and $1 million, is steadily increasing, indicating that large investors are actively positioning for potential profits in July.

Link whale transaction counts. Source: Santiment

This rise in this high-value transaction suggests that it will strengthen the bullish momentum in the price of the link. If this trend persists, it could further promote upward pressure and boost the Altcoin price to $15.53.

On the other hand, if demand drops, the token price could immerse itself in $11.04.