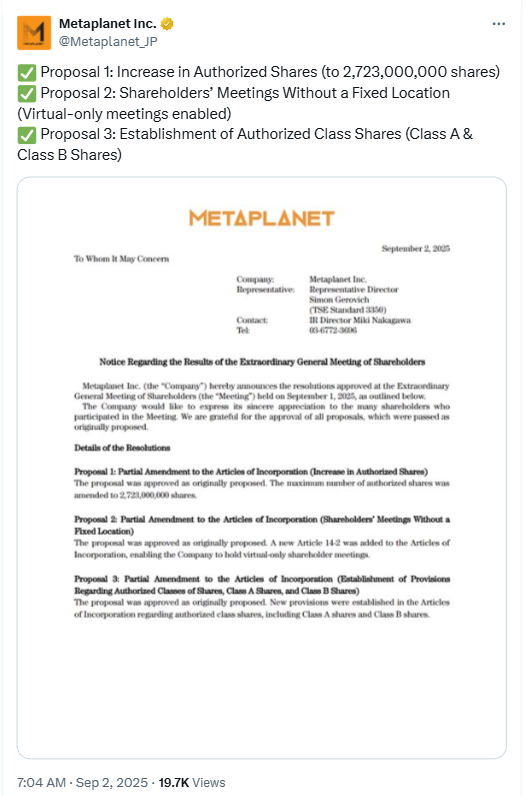

Bitcoin generates generational returns for investors who joined digital assets 10 years ago, and Bitcoin miners look like this:

The infrastructure Bitcoin mining companies used to minify Bitcoin are uniquely positioned to leverage artificial intelligence.

Investors are beginning to see Bitcoin Miners as AI companies

Frank Holmes, executive chairman and co-founder of Hive Digital Technologies, told Beincrypto it would take three years to build a data center from scratch. This is because details such as permits, logistics, and data center construction must be considered.

However, the path to converting a Bitcoin mining data center to an AI data center does not take time.

“If infrastructure is already built from Bitcoin mining, it’s nine months to improve your data center,” Holmes said.

Hive’s market capitalization is over $600 million. However, the company does not consider itself a bitcoin miner. The company is a vertically integrated, renewable AI infrastructure company, and Wall Street analysts agree.

Analysts’ aggressive price targets range from $6 to $12. Hive Stock currently trades for around $3 per share. This means an increase of over 300% from the current level.

Hive Digital 6-month stock chart. Source: Google Finance

Some institutional investors are beginning to notice as well.

Citadel Securities recently revealed a 5.4% stake in Hive. It’s been another year since Hive recently established its US headquarters.

Holmes said retail investors have driven many of Hivestock’s initial momentum.

These types of stocks tend to make a big profit when institutional investors participate, and investments in indexes like the Russell 2000 attract more capital from those investors.

Investing in Bitcoin miners has become a popular trend among large investors. Wonderful ‘Kevin O’Leary, a well-known investor at Shark Tank, has also invested in Bitcoin Mining and Power Infrastructure Company Bitzero.

On an exclusive podcast with Beincrypto, O’Leary explained his strategy.

“If I had to start investing in gold 300 years ago, I would have invested in gold, gold miners, companies that made jeans, picks and shovels, and I would have done much better than owning gold.

Bitcoin Miner AI Opportunities

Most investors know about AI opportunities, but not many know how big it will be.

Large tech companies are the leading leaders, and a single contract with one of these companies can surge Bitcoin miners.

Terawulf shares, for example, rose nearly 60% a day after signing a $3.2 billion deal with Alphabet. Shortly after the agreement was announced, Alphabet raised its shares in Terawulf.

Terawulf is building one of the largest data center campuses in the United States, backed by some of the most respected names in technology.

@core42_ai @fluidstackio @google $ wulf

@paulbprager @sullycnbc @cnbc @powerlunch pic.twitter.com/99dyzngufth

-Terawulf (@terawulfinc) September 3, 2025

Limited power supply and data centers position crypto miners to sign such transactions in the future.

However, the biggest opportunity for Bitcoin miners sitting on AI infrastructure may not even be the large tech companies that dominate the headlines.

Holmes believes that innovation on the battlefield will make the military and government a client of large AI data centers.

Drones, autonomous robots, and autonomous vehicles are some of the advanced technologies that use AI data centers as their backbone.

“More money goes to AI. If you have all these drones, you’ll need a data center and a satellite. The intersection will be a sovereign data center.”

Bitcoin Miners are undervalued compared to data center inventory

Bitcoin Miner is a major player in the AI data center boom, but few investors are aware of this opportunity.

In particular, when looking at the ratings of Bitcoin Miners compared to traditional data center stocks, the opportunity is still in the early innings.

“If you look at the typical data center ETFs there, you can see that they trade at 20 times the Ebitda, but Bitcoin miners like Hive are trading at less than twice the Ebitda,” Holmes told Beincrypto. “I think you’ll see this revaluation. I’ve seen Core Scientific Get 14 times as it trades at CoreWeave at 40x EBITDA. You’ll see a revaluation, but in five years, I think the data center will become an invaluable asset.”

CoreWeave started in 2017 as a Crypto Mining Company known as Atlantic Crypto. Now, it has been valued at around $50 billion since it fully embraced AI data centers.

As much capital flows into the industry, valuation and financial growth rates can move quickly.

Unlike the dot-com bubble, which was filled with eyeballs but lacked cash flow, AI is already producing concrete results in record time.

CoreWeave Stock Price Chart. Source: Google Finance

Holmes said Openai has made between $0 and $1 billion in monthly revenue within two years.

Hivestock is more than doubled from its 2025 low, but it is not the only crypto mining stock that can perform. Aylen has more than doubled since the start of the year, but crypto mining has more than tripled its 2025 low.

All three stocks enjoyed a strong rally in the second half of August. If Bitcoin mining experts like Holmes are right about how they will unfold over the next few years, those big profits could be just the beginning.

The reason why Bitcoin Miner sits in the generation of AI Goldmine was first introduced in Beincrypto.