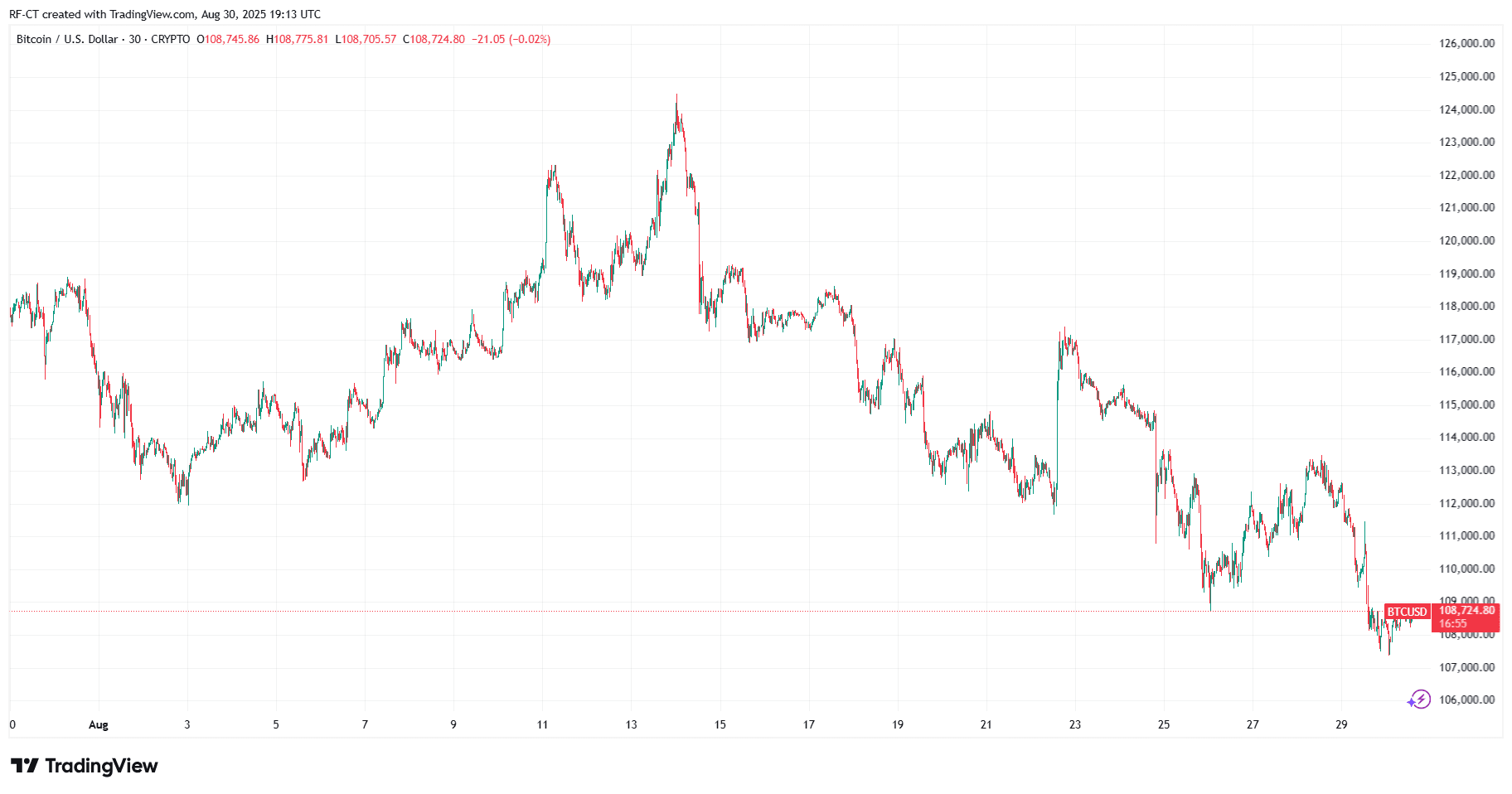

The Bloody End Until August 2025

Bitcoin (BTC) and Ethereum (ETH) are feeling heated. BTC fell nearby $110KETH slid down $4,360 Inside $15 billion option expires And the end of each month approaches. Traders call this a manipulation play to wash away leverage from whales, but fear is real. $100,000 Psychological Line for September 2025?

Optional expiration dates and market games

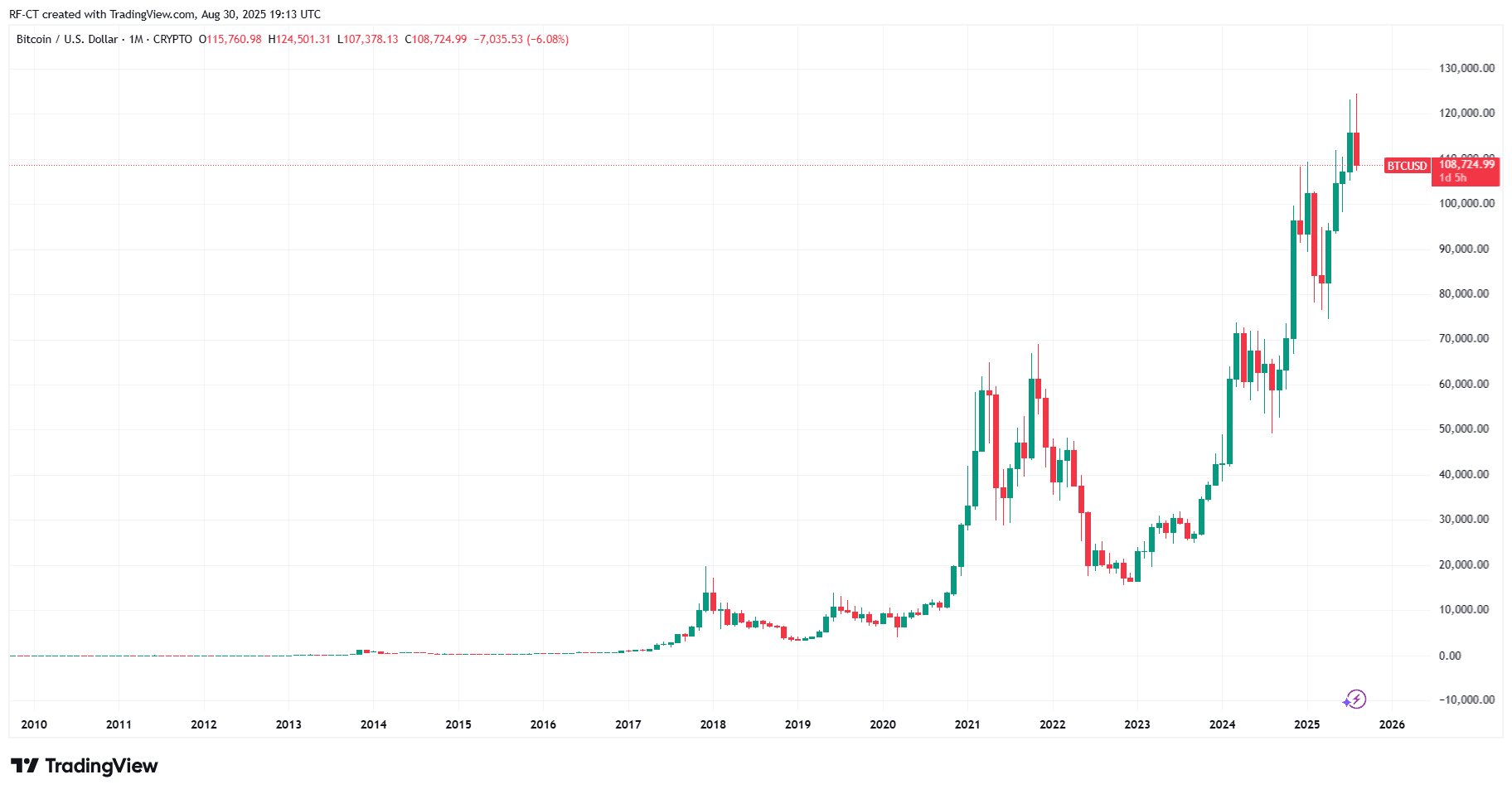

Historically, Large validity period Create A sharp, sudden dump As a market maker, hedge positions and forced liquidation. The timing of this sale is no coincidence as BTC is gaining open interest. Similar setups in past cycles (2017, 2021) show that once the expiration dates the market often stabilizes, but only after a brutal shakeout. September could be opened in this same scenario, allowing traders to gain an advantage.

Macro Image: Global liquidity is increasing

Despite the panic, there is a powerful bullish force lurking in the background. Global M2’s liquidity has become the best newest everand Bitcoin has historically followed liquidity growth with a slight delay. The branch we are looking at now – a liquid pump while the BTC is soaking – this modification is temporary, The early weakness in September could potentially set a stronger rebound later in the month.

September 2025: Bearish start or bullish setup?

Traditionally, September is one of Bitcoin’s weakest months. The post-Harking years have seen awkward third quarter action before a massive fourth quarter rally. The first day of September could extend current weaknesses, and BTC is at risk of testing 107K to 103K zone and ETH targeting $4,100-4,050 If sales pressure continues.

However, if BTC is collected 113.5k~116kETH will recover 4.45k~4.60kthe market could flip quickly, turning September into launchpad, making it a powerful fourth rally.

Things traders should see

- Bearish break: BTC slips down 109kcheck the target with 107k→103k. ETH has risks on slides 4.10k.

- Bully recovery: BTC Break 116kETH is cleared 4.60kwe will check for new momentum.

- Fluidity signal: The rise in M2 suggests that September DIPS may be short-lived.

Headlines may crash crash, but history says this looks more Shake out during September Not the end of the bull cycle. Yes, bitcoin can be easily cheated The 10,000 dollar level for September 2025,but Macro Fluidity Wave It’s still pointing high. If the moon fades, the larger picture remains. Q4 could be a rally that no one wants to miss.