Ethereum prices are below the key support level of $1,800. Prices fell to an intraday low of $1,754 as the market continued to consider key support and resistance levels.

Analysts believe that the direction of ETH prices will vary depending on whether the consolidation continues or recedes.

Ethereum priced at $1,762 to test important support

Ethereum price trends over the past few days show a series of bearish candles, reflecting a 12% decline.

Price Action bouncing off at $1,762 with S1 Pivot support. This is a very important zone where prices were previously rebounded. Analysts emphasize that Ethereum’s movement at this level can determine the next major price shift.

Famous analyst Crypto General points out that Ethereum Price forms the base at $1,800. If this support fails, the price of Top Altcoin could drop to $1,500.

For example, if prices bounce above the level above $2,000, the bullish trend is expected to resume. This level has been viewed as a psychological level for Ethereum traders in the past.

Source: Crypto General, x

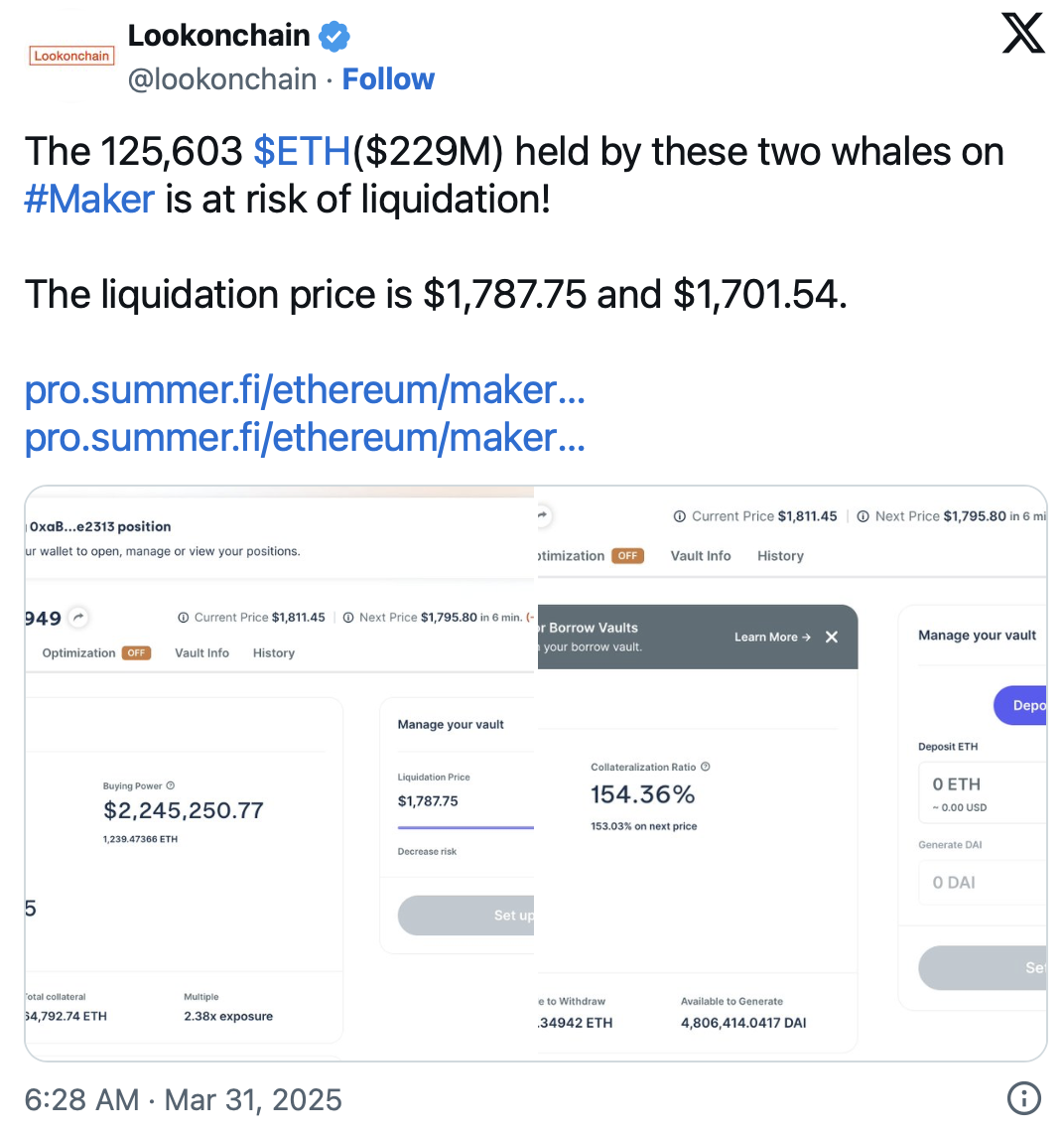

Whales face a $229 million liquidation risk

The current price decline is now even higher than the risk of liquidation for large Ethereum investors. Two large whales from Makerdao hold Ethereum near liquidation levels, according to Lookonchain data. These whales collectively hold 125,603 ETH, worth around $229 million.

Source: x

According to Lookonchain, the liquidation price was around $1,787 and $1,701.

However, if Ethereum prices drop further, liquidation could increase as sales pressure increases. This will further reduce ETH prices and extend the ongoing revision phase.

Ethereum’s double bottom reversal potential

Despite recent bearish trends, analysts are looking at double-bottom patterns formed based on ETH Price’s everyday behavior.

The double-bottom inversion pattern means the end of the bear phase as the price moves upwards. This forecast can only be achieved if Ethereum prices remain in positions above $1,762 and retests resistance levels of $2,100.

Crypto analyst Jonathan Carter noted that ETH prices appear in a falling triangle.

His analysis shows that if the price exceeds the support level, the breakout will increase the price to $1,950, and ultimately it will be $2,080. Carter kept his price target at $2,230 and $2,320 if the bullish momentum was strengthened.

Source: Jonathan Carter, X

ETH price needs to be regained $2,100

The $2,100 resistance level remains an important barrier for Ethereum’s potential recovery. If Ethereum Price can integrate beyond this level, it could be a fresh purchase signal.

Analysts emphasize that we need to see the double bottom layer that Ethereum accumulates above this level.

However, if prices cannot be maintained above $1,762, the prospect of continuing bearishness is looming. As a result, if the price falls below $1,700, the ETH price will likely revisit the $1,500 level. This will be in line with the Crypto General’s prospects of pegging $1,500 as the next major support level if bear pressure continues.