Ethereum (ETH) has declined almost 6% over the past 24 hours, increasing its sharp decline over the week. With prices below $1,500, market watchers are increasingly questioning whether ETH could drop to $1,000 in April.

Liquidation, declining network activity and growing concerns about bearish technologies have fueled discussion. As investors’ feelings fluctuate, the next few days may prove important to Ethereum’s short-term trajectory.

If ETH falls below $1,200, nearly $342 million will be liquidated

Ethereum is currently just above the $1,500 mark, falling more than 15% over the past week as bearish pressures intensify across the crypto market.

The recent recession has sparked concern among traders, especially as ETH struggles to hold key support levels. Standard Chartered recently said that XRP could overtake Ethereum by 2028.

This decline reflects wider risk-off sentiment and uncertainty surrounding altcoins, with Ethereum now dangerously close to levels that could cause a major wave of liquidation.

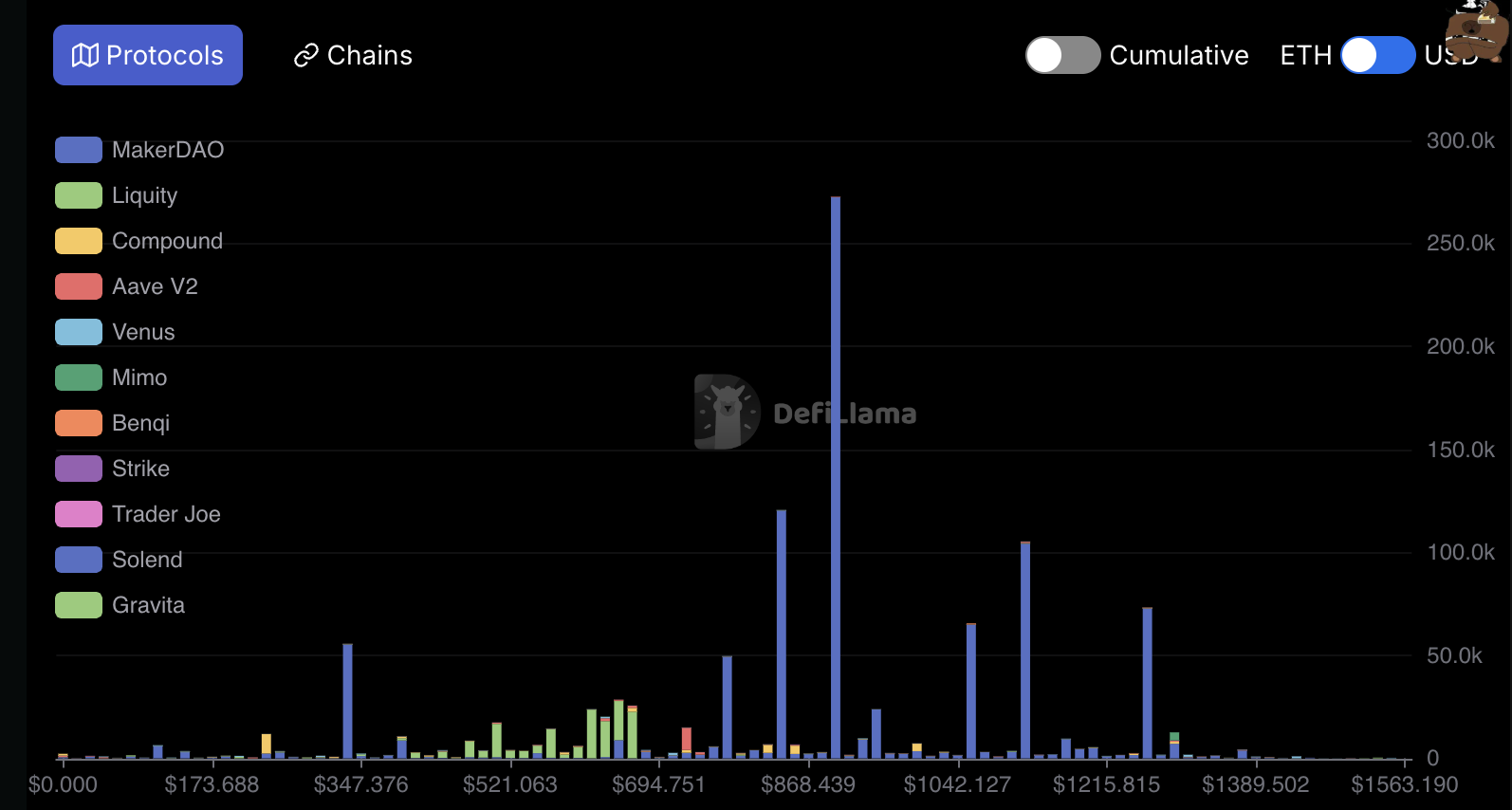

Ethereum liquidation. Source: Defilama.

According to on-chain data, if ETH falls below $1,200, it could result in a liquidation of approximately $342 million across all leveraged positions.

Liquidation occurs when traders who borrowed capital to reach Ethereum for a long time are forced to hold due to a fall in price. This effectively amplifies the drawbacks and increases sales pressure.

Focusing on this situation, investor Peter Schiff won the X and warned him that he wouldn’t expect it to take before Ethereum fell below $1,000.

Ethereum TVL has declined 43% since December

Ethereum’s Total Value Lock (TVL) has been declining sharply since peaking at $86.6 billion in December.

To date, Ethereum’s TVL has fallen to $49.34 billion, down 43% in just a few months.

This decline highlights the decline in user activity and capital outflows from Ethereum-based protocols, raising new concerns about the network’s short-term momentum.

Ethereum tvl. Source: Defilama.

TVL measures the total capital deposited in distributed financial (DEFI) protocols on the blockchain and serves as a key indicator of ecosystem health and investor trust.

The rise in TVL generally indicates an increase in trust and use of defi applications, while the decline in TVL suggests a decrease in demand and a decrease in engagement.

Ethereum’s TVL is currently hovering at a low of several months. This could be a bearish signal for ETH prices. This reflects a decline in utility and a decline in capital circulating through the network, both of which could put further downward pressure on assets if the trend continues.

Ethereum is currently down 70% from its all-time high

Ethereum prices have been trading below $2,000 since March 26th, and its technical indicators are not visible Promising.

The current setup of exponential moving averages (EMAS) shows the formation of bearishness in which long-term Emma is placed under long-term momentum.

This suggests that the seller is still under control and the market may be decorated for further modifications.

ETH price analysis. Source: TradingView.

If the bearish momentum continues, Ethereum may retest nearly $1,400 in support. A breakdown below that level could lead to a deeper sale, with Ethereum priced at $1,000 in April. This is at an important psychological and historical level.

However, once the Bulls regain control and reverse the trend, ETH can first challenge resistance for $1,749.

If the above breakouts open the door for a $1,954 test, and the momentum remains strong, Ethereum will overtake the $2,000 barrier to aim for $2,104.