Ethereum (ETH) prices have been trading nearly $2,470 after a 6% decline in three days, raising doubts about their next move. The weekend started with a 4% DIP, but data on whale activity and derivatives suggest that ETH can still be recovered.

Large traders remain bullish, with technical indicators pointing to the short-term consolidation zone. Marketwatchers are closely monitoring whether Ethereum can quickly regain the $2,600 mark.

Exchange spill points to supply shock

Over 1 million ETH have been withdrawn from exchanges over the past 30 days, supply has dropped by 5.5%. According to data shared by Cryptobusy, Exchange Balances is currently at 17 million ETH, the lowest level since 2021.

Ethereum rose by more than $1,800 to $2,600. This pattern has mostly provided bullish momentum, mostly because cryptocurrency values rise after supply declines. Decreasing supply and increasing demand often lead to higher market prices.

Source: x

These large holders or whales have chosen to move their ETH to cold storage rather than keeping them in exchange. As a result, stock prices will no longer fall, and in many cases they may show confidence in traders’ upward trends. Traders are closely monitoring the market to see if it exceeds 2,500 points.

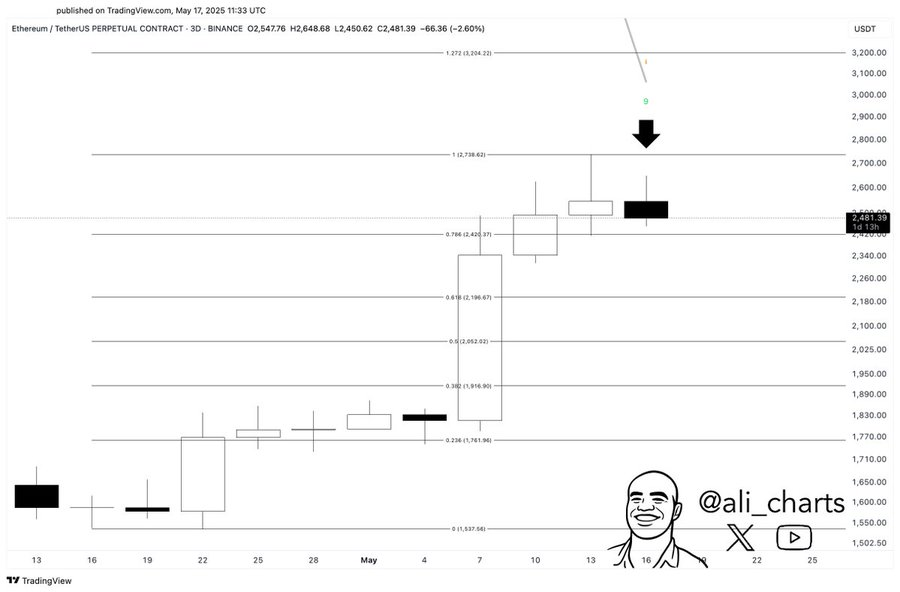

TD sequential signal warning of short-term correction

This means that Ethereum is creating new lows and new highs on the 3-day chart. After surpassing the 0.618 and 0.786 levels of Fibonacci retracement, it is below $2,500 just below the resistance. However, according to the TD sequential indicator, a sales signal of “9” will be displayed on the same chart.

This pattern often suggests short-term profits. Ethereum immersed in $2,457 after not holding more than $2,500. Nevertheless, it is above the $2,403 0.786 Fibonacci level. If the price breaks past $2,400 and again exceeds $2,500, analysts expect a push to $2,738, or in some cases $3,104.

Source: x

Indices such as the relative strength index (RSI) were cooled from excessive conditions and fell from 70.85 to 66.78. The histogram is contracting, but the moving average convergence divergence (MACD) still shows bullish momentum.

Whale activity and derivative data support bullish structure in Ethereum prices

Coinglass data shows that Binance’s top traders remain bullish at Ethereum, with the long/short ratio being 3.04 in accounts and 2.66 in positions. This means that over 75% of major traders expect price growth.

Despite a 12.78% decline in ETH derivatives volumes, it fell to $722.7 billion, but open interest remained stable at $30.84 billion. Although the volume of options has decreased, the options have risen slightly to $7.255 billion, suggesting continuous long-term positioning.

Liquidation data shows $93.14 million cleared over the last 24 hours, including $81 million from its advantages and just $12 million from its shorts. This indicates that the price did not drop significantly due to the recent sale. Over the past two weeks, ETH has increased by just 35%.

Source: Coinglass

Market volatility often saw $1,986 and $2,196 as reliable support for Fibonacci’s retracement levels. The price of Ethereum that holds above these zones suggests that this trend remains intact. As the new week begins, whale activity and derivatives data can help retest Ethereum and regain the $2,600 level if momentum accumulates.

Ethereum price integration near major support levels

ETH has grown 39.84% in just a few weeks, and is now $2,508.70, representing one of the biggest monthly profits in a while. When the market recovers after a long slump, it often creates a bullish reversal pattern, indicating that both price and trust can rise.

ETH’s value is currently stable beyond VWAP at $2,485, a key area most investors are paying attention to. It suggests that the market can become very active as the bands on the Dokian channel approach. If ETH is traded above $2,500 and there is a high volume of trade, it could reach up to $2,600 and $2,738. Still, if the price falls below $2,450, it could lead to another test of $2,235-$2,200.

The market is closely observing whether ETH is above $2,500. An increase in trading volume may confirm prices are rising. If purchase demand decreases, Ethereum will remain in a limited range, with traders waiting for updated confirmations.