Cathie Wood’s Ark Investments has filed an S-1 filing with the U.S. Securities and Exchange Commission. $ARK CoinDesk 20 Crypto ETF, Highlighted $XRP It is one of the Fund’s most important holdings.

The application, filed yesterday, specifically highlights the institution’s growing confidence in diversified crypto exposure beyond Bitcoin to assets such as: $XRP.

Important points

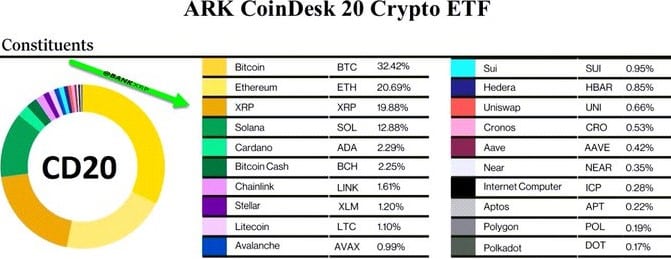

- $XRP is one of the fund’s largest holdings, with a weight of 19.88%.

- It ranks behind Bitcoin (32.4%) and Ethereum (20.69%) in the overall index.

- The ETF’s shares will be listed and traded on the NYSE Arca, Inc.

- Estimated launch funding is about $437,000, according to filings.

$XRP Approximately 20% allocation can be seen

The proposed ETF will be filed on January 23, 2026 and will track the CoinDesk 20 (CD20) index. especially, $XRP has a significant weight of 19.88%, making it one of the top components of the fund. The token ranks only behind Ethereum and Bitcoin, which are assigned 20.69% and 32.4% weighting respectively in the overall index.

Other major cryptocurrencies in the fund include Solana, Cardano, Bitcoin Cash, Chainlink, Stellar, Litecoin, and Avalanche, with respective weights of 12.88%, 2.29%, 2.25%, 1.61%, 1.20%, 1.10%, and 0.99%.

Meanwhile, Ark Invest will serve as the fund’s sponsor, and CSC Delaware Trust will act as trustee. In particular, the Fund’s shares will be listed and traded on the NYSE Arca, Inc. The fund’s nominal seed value is currently $100, and starting capital is expected to be approximately $437,000.

what this means $XRP

$XRPWith an allocation of nearly 20%, the organization is firmly in the spotlight. Inclusion at this scale is $XRP As a liquid investable asset suitable for regulated products.

For market participants, this will strengthen $XRPThe case for a long-term component of a professionally managed crypto asset portfolio could support deeper liquidity and broader adoption if the ETF is approved.

$XRPIncreased presence of spot ETFs as a whole

$XRPis included $ARK The CoinDesk 20 ETF builds on an already growing footprint of US-listed crypto funds. Over the past year, the token has been a core component of several major basket ETFs, including the Bitwise 10 Crypto Index Fund (BITW), the Grayscale Coindesk Crypto 5 ETF (GDLC), and the Hashdex Nasdaq Crypto Index US ETF (NCIQ).

Beyond diverse products, $XRP It is also attracting attention through single-asset spot ETFs. Currently 5 $XRP Spot ETFs are traded on US exchanges and are offered by Grayscale, Franklin, Bitwise, Canary, and 21Shares.

Since Canary launched the first of these in November, the group has had net inflows of $1.23 billion, bringing total assets under management to approximately $1.36 billion.