$XRP Last week, it emerged as the only top asset with positive ETF flows, even though ETF flows were strong. Bloodshed that devastated the market.

of cryptocurrency market witnessed One of the worst performances last week was: February Five things stand out in particular. Specifically, the market lost $310 billion in valuation on that day, making it the worst day since October 10, 2025, when it lost $383 billion in a selloff that resulted in more than $19 billion worth of liquidations.

$XRP was one of the hardest hit in the Feb. 5 decline, but despite the price fight, institutional adoption continued to trickle up. Specifically, last week, $XRP It emerged as the only top asset to record positive ETF flows, pulling in nearly $45 million. $BTC, $SOLand $ETH A leak was observed.

Important points

- $XRP It plunged more than 19% on February 5, amid a market crash that wiped out $310 billion worth of capital from the crypto market.

- While prices are struggling, $XRP Interest in institutional investors has increased $XRP ETF products saw inflows worth $45 million last week.

- This bullish institutional position $XRP In isolation, Bitcoin, Ethereum, and Solana ETFs have been outflows instead.

- latest performance represents $XRPFirst weekly ETF positive record in the past three weeks; after losing $92 million in two weeks return.

- franklin templeton $XRP ETFs were the biggest contributor to last week’s $45 million inflows, raising more than $20 million alone.

$XRP ETFs record inflows despite price struggles

This is accordingly Market data provided by Coinglass, as market eye Recovering from last week’s chaos. in particular, February 5, $XRP Collapsed before 19.6% drop down Deeper Rise to 15-month low of $1.11 the next day. The rebound continued on February 6th, but $XRP It remains in bearish territory, ending last week down 10%.

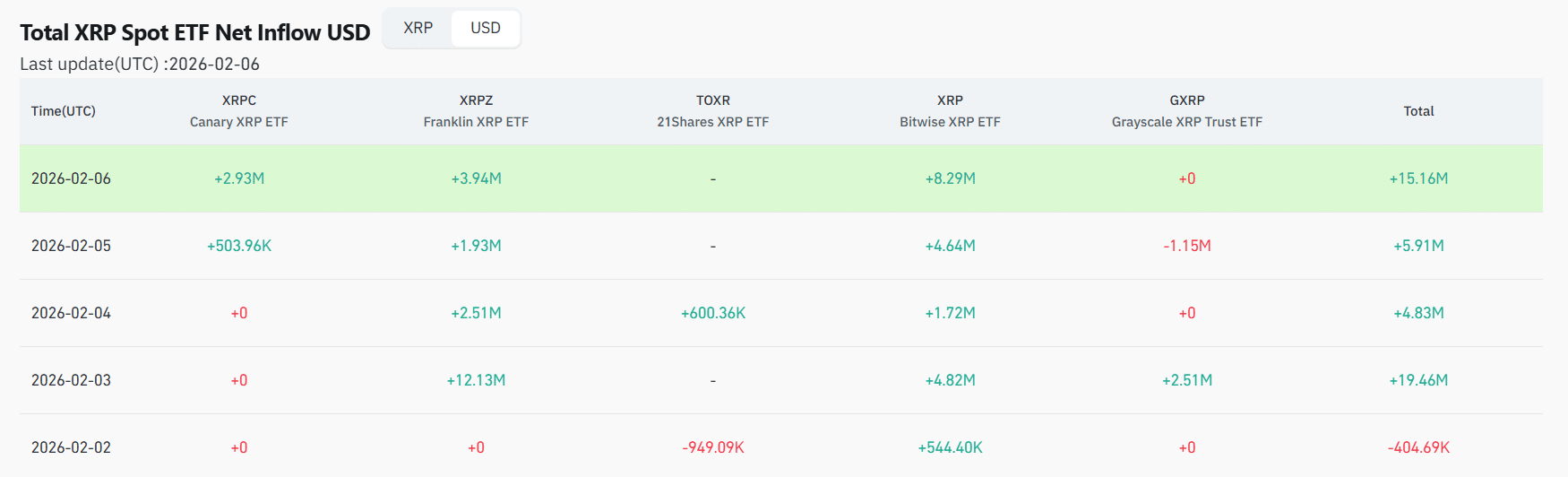

despite this, $XRP Last week, ETFs had four out of five intraday inflows. Notably, only one spill was involved. –$404K above February 2. As the week progressed, we only saw inflows into products, including $19.46 million. February 3, $4.83 million February 4, plus $5.91 million February 5. On the day $XRPprices fell by 19%. On February 6, the product had inflows of $15.16 million.

$XRP ETF inflow | Coin glass

Together, these flows amounted to $44,956,000 worth of net capital inflows last week. $XRPETF’s weekly performance was positive for the first time in the past three weeks. For the week ending January 23rd, $XRP The ETF recorded net outflows of $40.64 million. The following week, the amount of outflows reached $52.26 million, following a $92 million outflow on January 29th. Within the last two weeks, $XRP The ETF lost $92.9 million.

which one $XRP Did ETFs contribute the most?

What is noteworthy is the recent recovery Most come from contribution of two people $XRP ETF Product: Franklin $XRP ETF (XRPZ) and Bitwise $XRP ETF($XRP). these products was drawn in A total of $40.5 million; represent More than 90% of all ETF flows have come in since last week.

Of the total inflows of $40.5 million, net inflows to XRPZ were $20.51 million, the largest inflow of any financial institution. $XRP Last week’s ETF. On the other hand, Bitwise $XRP It recorded an inflow worth $20,014,000.

Although Canary Capital’s XRPC has not recorded any intraday outflows, only saw net inflows of $3.43 million; look Most days there is no flow. Grayscale’s GXRP saw net inflows of $1.36 million. 21 shares $XRP ETFs were the only product to see outflows last week, with outflows worth $348,000.

$BTC, $ETH, $SOL ETFs are losing money

meanwhile $XRP Although the ETF has moved to recoup losses from the past few weeks, outflows into products related to Bitcoin, Ethereum, and Solana continue.

in particular, Bitcoin ETF recorded capital outflows worth $358 million last week, while Ethereum ETFs saw capital outflows worth $170.4 million. Meanwhile, the Solana ETF witnessed outflows worth $9.3 million, most of which turned into losses. come February 6th, introduced Capital: $11.9 million go out to Solana products.