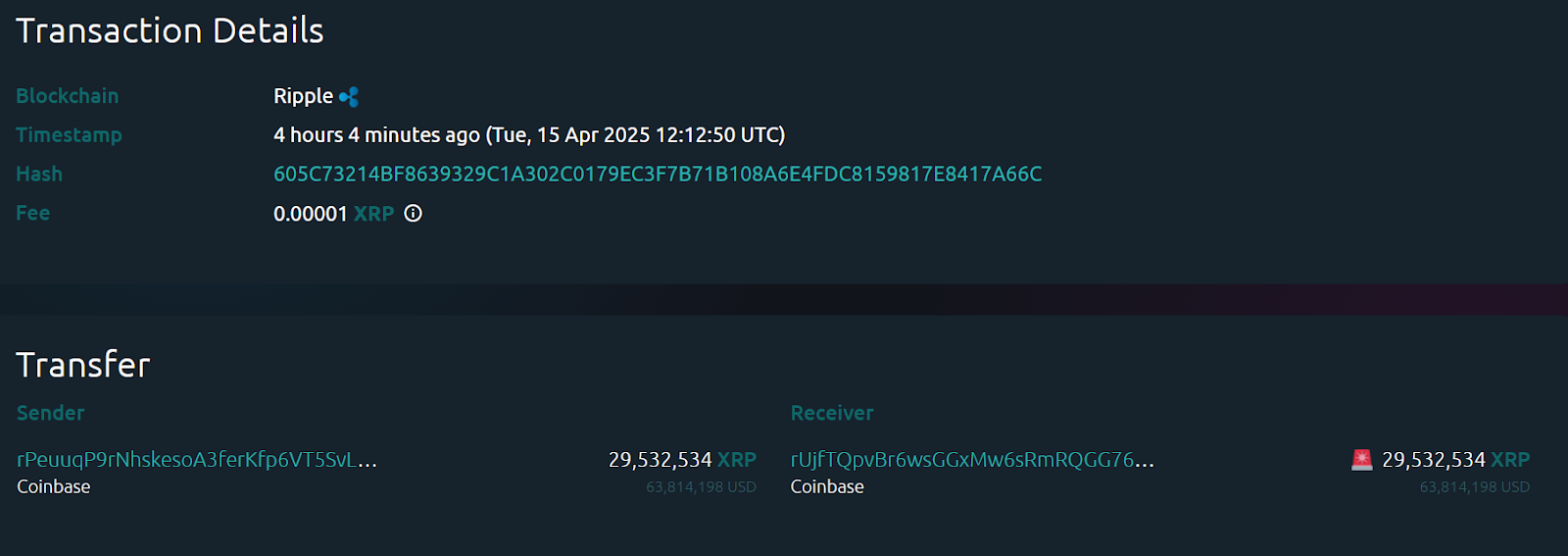

XRP recorded a notable large transaction after an unidentified whale moved 29.5 million tokens worth around $63.8 million to the cryptocurrency exchange Coinbase.

Analysts on the chain often interpret such a large transfer as a bear signal as a bearish signal, as they usually suggest that the owner may be preparing for sale.

A large influx into centralized exchanges can increase short-term sales pressure and can negatively affect prices.

The April 15 deal comes amid the growth of hype around the approval of the potential spot XRP Exchange-Traded Fund (ETF).

XRP ETF hype

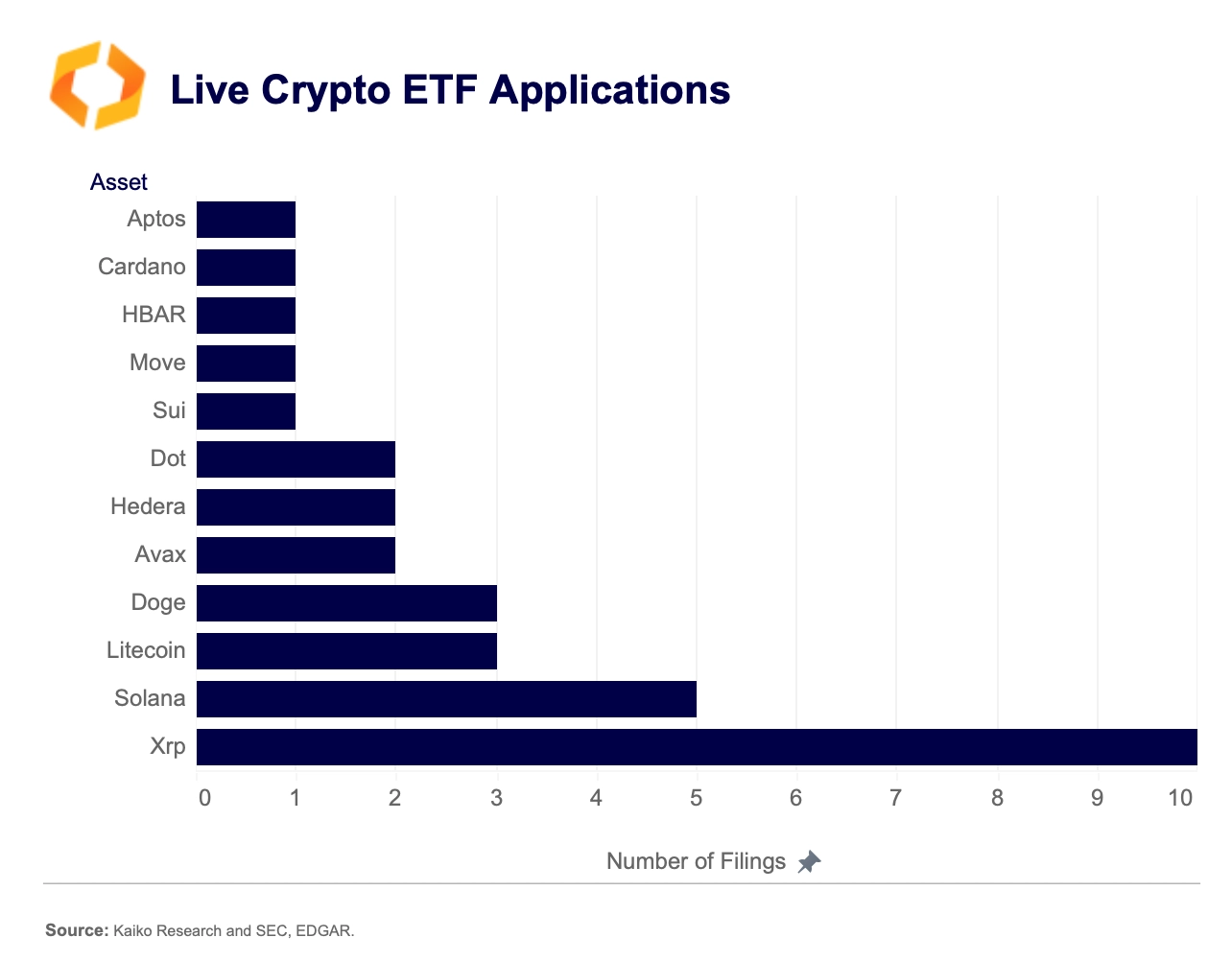

Data shows that XRP led the Spot Cryptocurrency ETF race. The token currently has at least 10 active ETF filings than any other Altcoin, including Solana, Litecoin, and Dogecoin.

Among the names of XRP ETF applications are Bitise, Proshares, Grayscale, Wisdomtree, Franklin Templeton, and Hashdex.

The filing gusts mark an important milestone in XRP. Regulators must decide on the product by mid-October.

In particular, the likelihood of such products being approved has been greatly boosted as the long-standing SEC vs Ripple cases are approaching their conclusions.

Meanwhile, Teucrium has recently increased XRP liquidity by launching a double-utilized XRP ETF that tracks European ETPs and swaps to provide double XRP daily returns. It became Teucrium’s top performance fund, trading over $5 million on the launch day, and XRP has given significant momentum in sought US Spot ETF approval.

XRP Price Analysis

As of press time, XRP was trading at $2.13, earning around 0.6% in the last 24 hours. Over the past week, tokens have spinned more than 12%.

The price of XRP is currently grasped between short-term bearish bias below the 50-day simple moving average (SMA) and long-term bullish structures held above the 200-day SMA.

Combined with neutral market sentiment, it suggests that assets could see sideways or slightly downward movements unless new bullish catalysts such as ETF News rekindled momentum.

Featured Images via ShutterStock